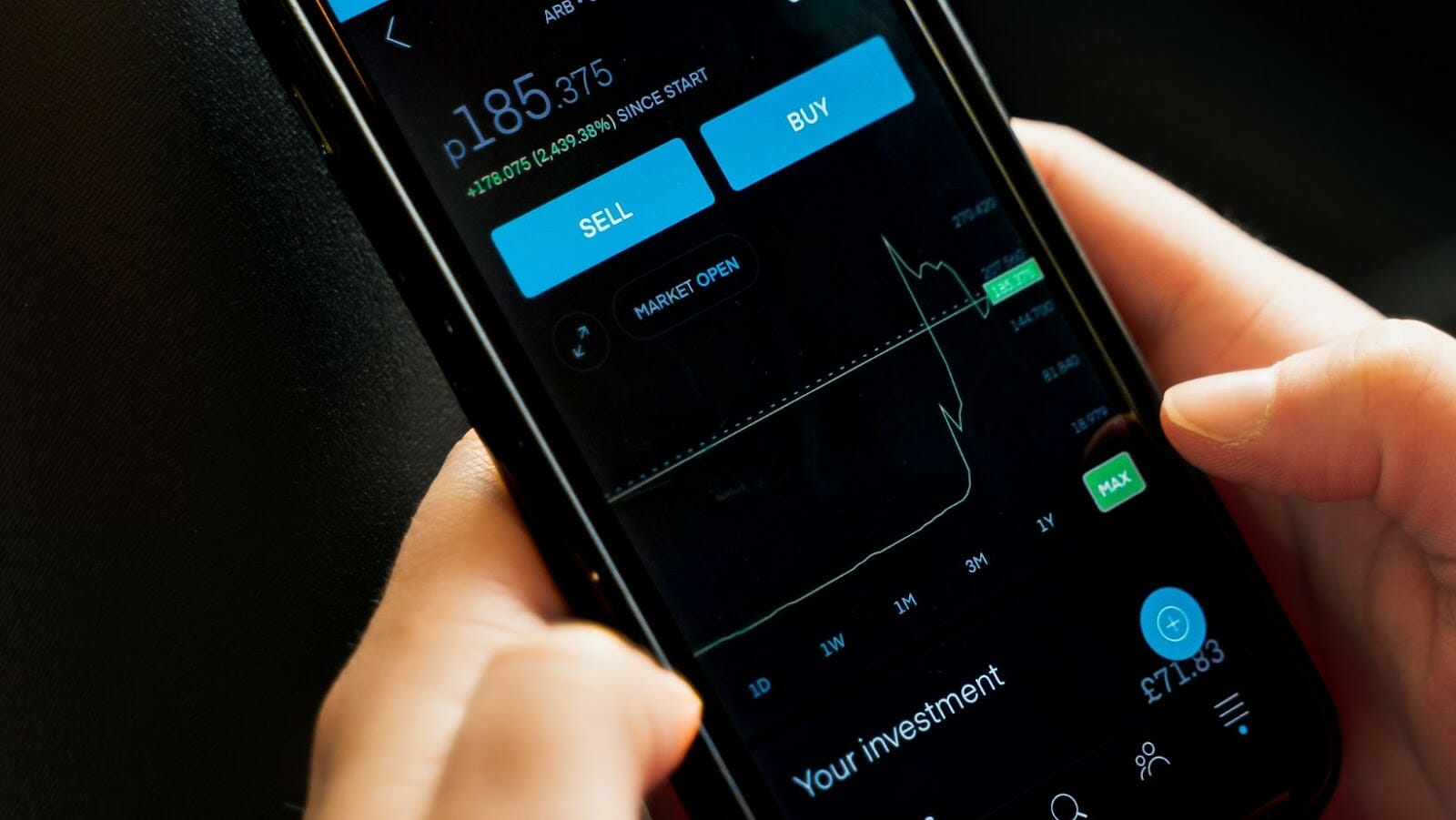

With the growth of crypto assets adoption in media, beginner traders have started to get interested in this field. Spot trading is the best option for those crypto trading newcomers because it is the less risky option. With the increased volatility of digital assets, traders try to optimize their profits using more advanced trading tools such as cryptocurrency futures.

What are Crypto Futures?

Unlike spot trading, when traders receive and hold assets immediately after the transaction proceeds, futures trading does not require holding coins. Futures are agreements that include the conditions upon which the trader will receive or sell coins in the future with the indication of the asset’s value and the deadline.

There are two scenarios:

- You may open a long position to wage on the crypto value growth

- Or you may go short and purchase crypto when its rate drops.

Thus, cryptocurrency futures trading allows traders to make a profit on a declining market and to speculate on the future value of assets.

What is Leverage?

Leverage brings the most important benefit for futures trading, for it allows a much better capital efficiency and allows traders to use borrowed funds to enter the futures agreement with better positions. Leverage allows to increase returns, but at the same time, it brings higher risks. The most appropriate leverage ratio is 5X or 2X. It is better to start with the smallest leverage ratio.

What Crypto Futures Platform to Use?

Not all crypto exchanges allow for futures trading. The services with the best reputation include OKX Futures, Binance, and WhiteBIT.

Try, for example, the WhiteBIT crypto futures exchange. It offers leverage up to 20X and a demo account for users to try this trading tool for a better understanding of how it works. You can try different leverage ratios with demo tokens and see how the size of leverage affects the potential profit and losses.